During the first half of 2020, a longstanding credit union was faced with a changing business model due to the COVID-19 pandemic. Customers that would normally visit retail branches and interact with a live teller were now asked to use personal teller machines (PTMs).

PTMs look like traditional ATMs but with one key difference—the touch screen connects members to a teller with a live video feed. PTMs were already part of their business model but represented a small percentage of overall transactions. With branch offices closed to the public, and more than 100k members, the number of PTM transactions significantly increased.

They faced several challenges:

- How to rapidly scale to a full digital business model within a matter of days to weeks.

- How to provide a secure and optimized video, chat, and transactional experience.

- How to monitor this hundredfold increase in traffic with limited IT staff.

Previously, IT staff could manually monitor the performance of PTM transactions, but now activity went from a few a week to thousands. Seemingly overnight, what was once an ancillary application became mission critical.

As ExtraHop customers, the credit union had a discovery call with one of our Professional Services Solution Architects (SAs). To develop a solution that fit the problem, the SA worked with the credit union to understand their infrastructure, root causes, impacts, and business objectives.

With limited resources, they needed someone with the expertise to envision how ExtraHop Reveal(x) could solve the challenges of scaling their increasingly digital business model. After understanding the situation, requirements, and potential issues, the SA was able to jointly create a vision of the desired outcome.

Integrations for Better Visibility

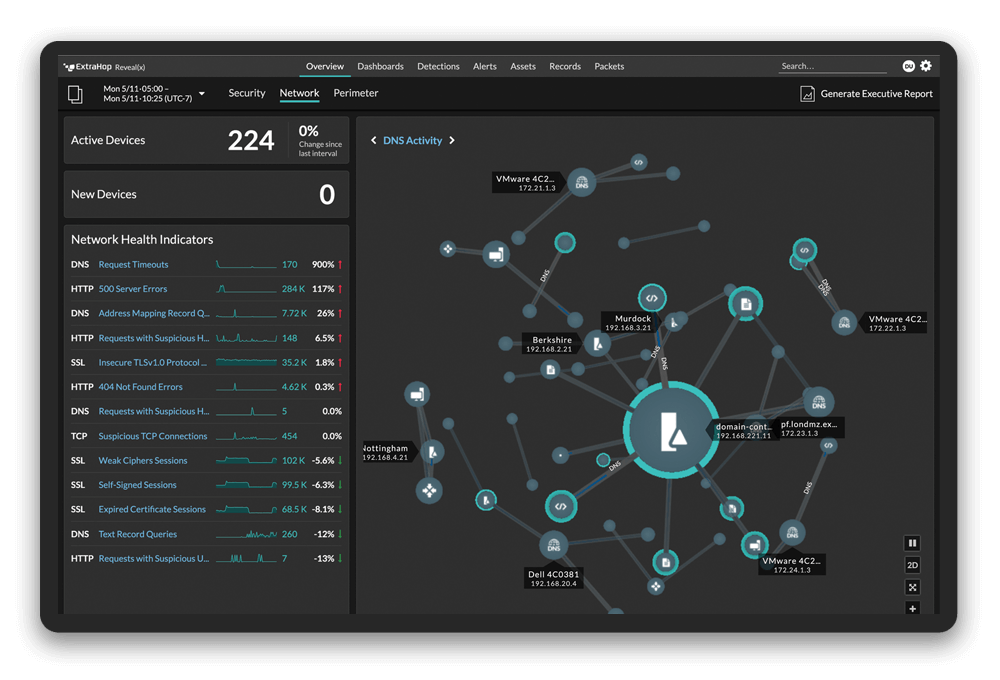

Reveal(x) had to integrate with a SIEM and CISCO ISE (Identity Services Engine) used to enforce their PTM security and access policies. That way, IT could use Reveal(x) to monitor authentication and teller access to the PTM from either a retail location or from a home office as needed.

In addition, monitoring the traffic traversing the PTM application servers at HQ and connecting to the various PTMs was critical. Clear visibility would help them ensure customers had a seamless experience even as volume exploded. This would require data correlation as no sensors were installed at the branch locations.

The SA delivered a set of dashboards that could monitor and alert IT to any performance degradations from the server (HQ) to the branch, even down to specific PTMs at the branch location. This enabled the IT team to quickly spot any issues at a particular site and allowed them to drill down to a specific PTM if remediation was required.

A dashboard was also created that allowed the IT team to track teller authentication events which improved their security posture as transaction volume ramped up dramatically. At any given point in time, data that correlated individual teller access, PTM function, and overall branch performance was available for incident investigation, troubleshooting, and optimization.

Scaling a Digital Business Model

With a little help from ExtraHop, the credit union was able to effectively transform their business model from hybrid retail to completely digital and scale volume while enabling a secure, optimized environment with no increase in IT staff.

We want to help you do more with Reveal(x)! Reach out to our ExtraHop Professional Services Team to learn more.